capital gains tax canada crypto

With capital gains and losses only 50 per cent of the gains are included into. Additionally The Canada Revenue Agencys CRA policy is to treat cryptocurrencies like properties when it comes to taxation.

Bitcoin And Crypto Taxes Frequently Asked Questions

We select useful information related to How Much Is Crypto Capital Gains Tax.

. Do I pay tax on crypto gains. List the best pages for the search Capital Gains Tax Selling Cryptocurrency. This means that cryptocurrency sold in 2021 should be reported in the tax return you.

This is called the taxable capital gain. List the best pages for the search Capital Gains On Crypto. How do I avoid paying tax on crypto.

And we definitely dont. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Gains from disposing of cryptocurrency should be reported in the following years tax return.

Establishing whether or not your transactions are part of. Note that only 50 of capital gains are taxable. How Much Is Capital Gains Tax On Crypto.

Remember you will only pay tax on your. All the things about Capital Gains Tax Selling Cryptocurrency and its related information will be in your hands in. There is no legal way to cash out crypto without paying taxes in Canada -whenever you sell trade spend or even gift crypto if you have a gain you have a tax liability.

This means you will need to pay capital gains taxes. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity. In most jurisdictions capital gains taxes range between 10-40 for short term capital gains under a few years and 0-10 for long-term.

All the things about Capital Gains On Crypto and its related information will be in your hands in just a few seconds. For example you might need to pay capital. Crypto tax rates range from 0 to 37 depending on several factors including whether your cryptocurrency is taxed as ordinary income short-term capital gains or long-term.

That would be a total of 300 in expenses you could also subtract from the gain for an example total capital gain of 4700. The most common type of crypto tax is the capital gains tax. Cryptocurrencies are taking the financial world by storm and leaving a lot of Canadian investors confused about the correct way to report their crypto on their Canadian Tax returns.

It is best to consult an experienced Canadian crypto tax lawyer to answer your questions about the specific details if you lost cryptocurrency due to theft fraud. Remember that the taxable capital gain is only half of the total. The Canada Revenue Agency CRA treats cryptocurrency as a property taxed either as business income or capital gains.

The taxable capital gain added to your income on line 127 would. However it is important to note that only 50 of your capital gains are taxable. When filing taxes Canadians need to list any capital gains from selling cryptocurrency in the income portion of their taxes.

How can I avoid paying taxes on crypto Canada. If youre looking for the data for How Much Is Crypto Capital Gains Tax GetCoinTop is here to support you. There are lots of different ways of calculating this but the most common way is to find the price of your cryptocurrency at the.

Capital gains from the sale of cryptocurrency are generally included in income for the year but only half of the capital gain is subject to tax. There is a difference in the tax treatment of capital gains and losses vs. Business income or loss.

This means that 50 of your gain is added to your income for the year and charged at your marginal rate. How does CRA know about cryptocurrency.

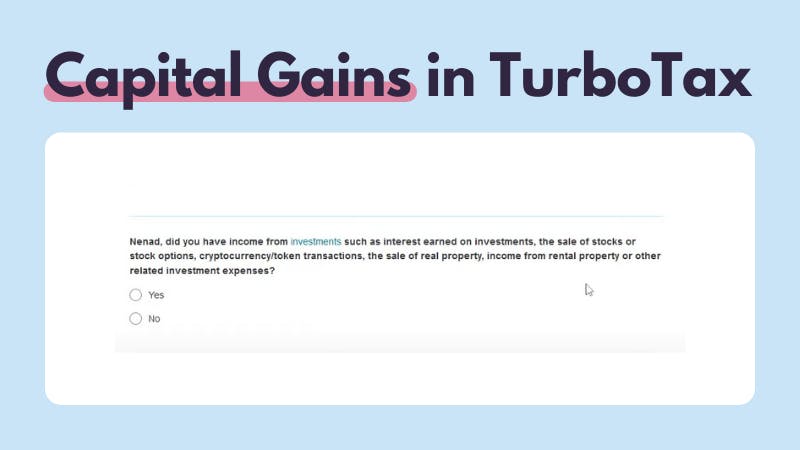

How To Do Your Turbotax Canada Crypto Taxes In 2022 Koinly

Crypto Taxes In Canada Adjusted Cost Base Explained

Thailand Scraps 15 Crypto Capital Gains Tax Following Public Backlash

Cryptoreports Google Workspace Marketplace

Tax Treatment Of Cryptocurrency Much Still To Be Determined Says Aba Panel Wolters Kluwer

Crypto Tax And Portfolio Software Cointracker

Cryptocurrencies And Other Digital Assets Take Center Stage In 2022 Part 2 Bloomberg Tax

7 Foolproof Tactics To Avoid Crypto Taxes In Canada Coinledger

Cryptocurrency Tax Calculator Forbes Advisor

Seven Countries Where Cryptocurrency Investments Are Not Taxed

Must Know Crypto Laws In Canada For Bitcoin Investors Your Taxes Identity And Transaction Records Youtube

Github Davidosborn Crypto Tax Calculator A Tool To Calculate The Capital Gains Of Cryptocurrency Assets For Canadian Taxes

Crypto Taxes As Capital Gains Youtube

How To Cash Out Crypto Without Paying Taxes In Canada 50 Bonus Yore Oyster

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Cryptocurrency In Canada Alexandria

The Ultimate Guide To Canadian Crypto Tax Laws For 2022 Zenledger

Tax Season Is Here How Are You Reporting Your Crypto By Toufic Adlouni Medium